- Financial Highlights

- Annual Audited Financial Statements

- Quarterly Earnings

- Segmental Performance

- Financial Ratio

Financial Highlights

Statement of Profit or Loss and Other Comprehensive Income - Key Data & Financal Ratios

Gross Revenue (RM mil)

Net Property Income (RM mil)

Income Available for Distribution

(realised) (RM mil)

Earnings per Unit (realised) (sen)

Distribution per Unit (DPU) (sen)

Distribution Yield (%)

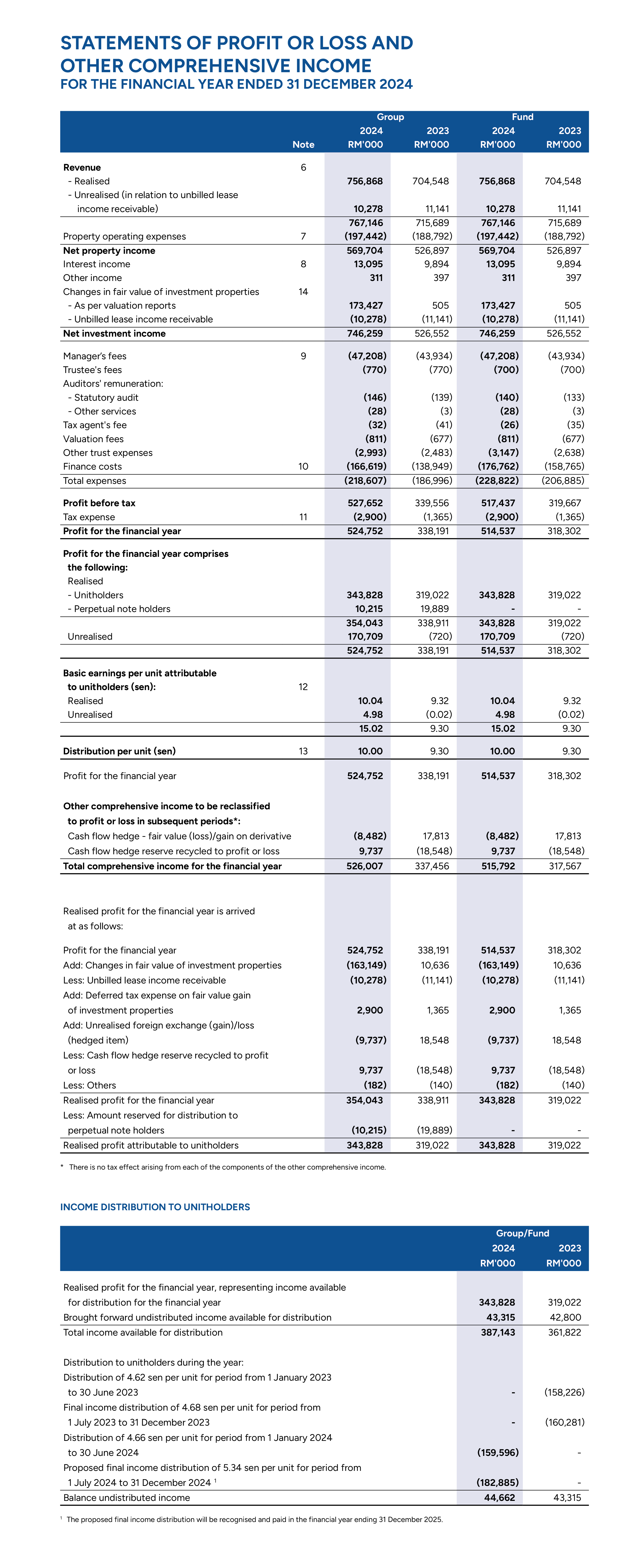

Statement of Profit or Loss and Other

Comprehensive Income - Key Data & Financal Ratios USD

Gross Revenue (USD mil)

Net Property Income (USD mil)

Income Available for Distribution

(realised) (USD mil)

Earning per Unit (realised) (cents)

Distribution per Unit (DPU) (cents)

Distribution Yield (%)

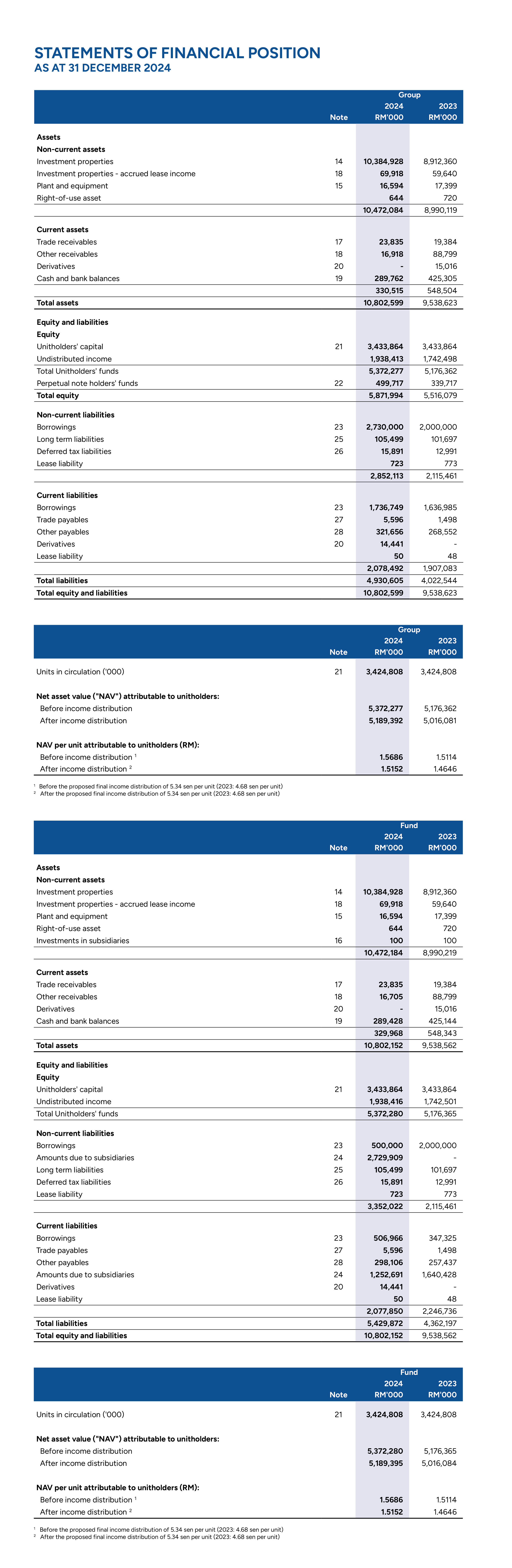

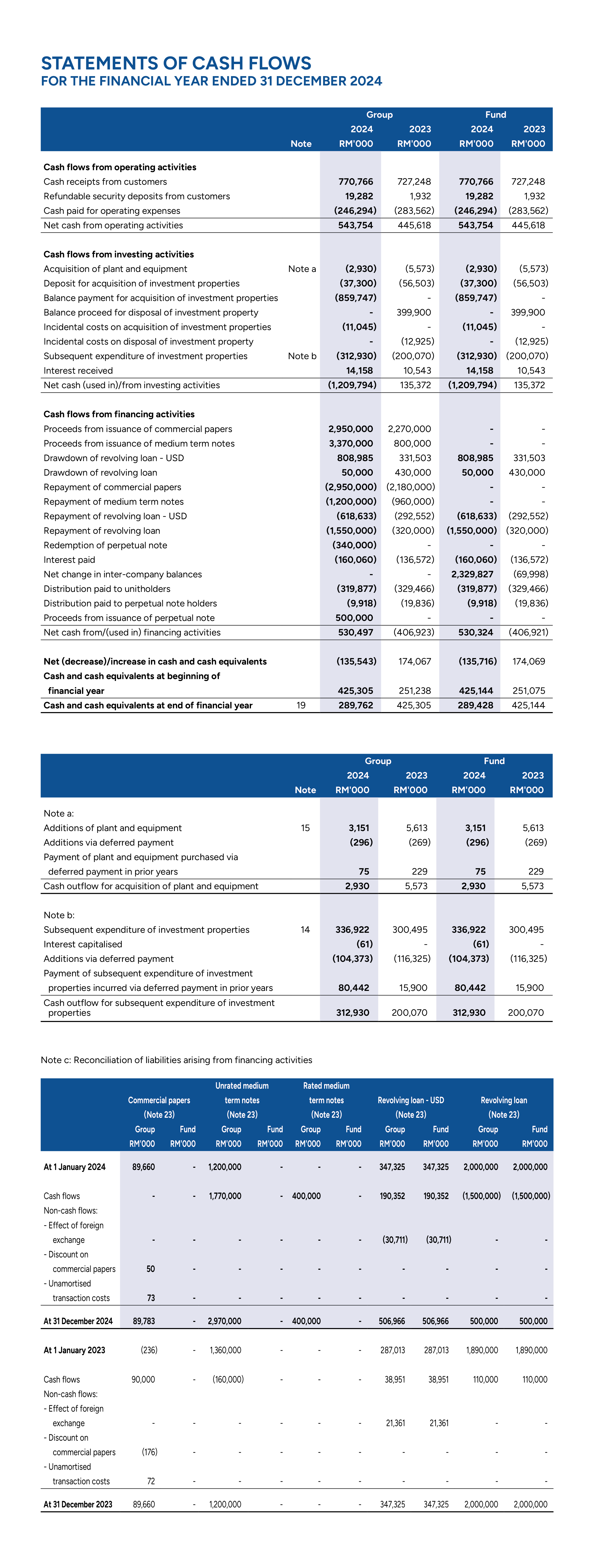

Annual Audited Financial Statements

For the Financial Period ended 31 December 2024

-

Comprehensive Income

-

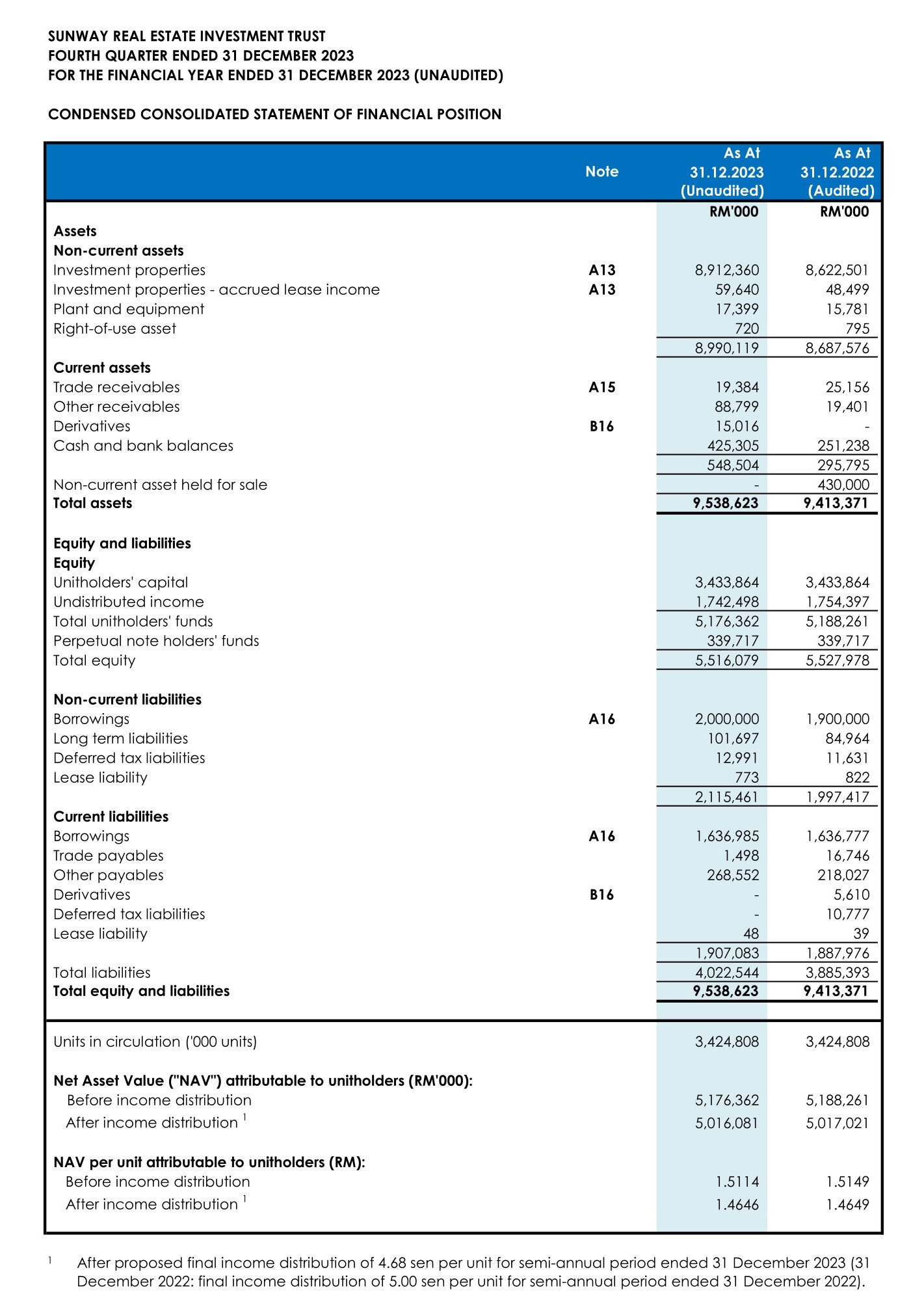

Financial Position

-

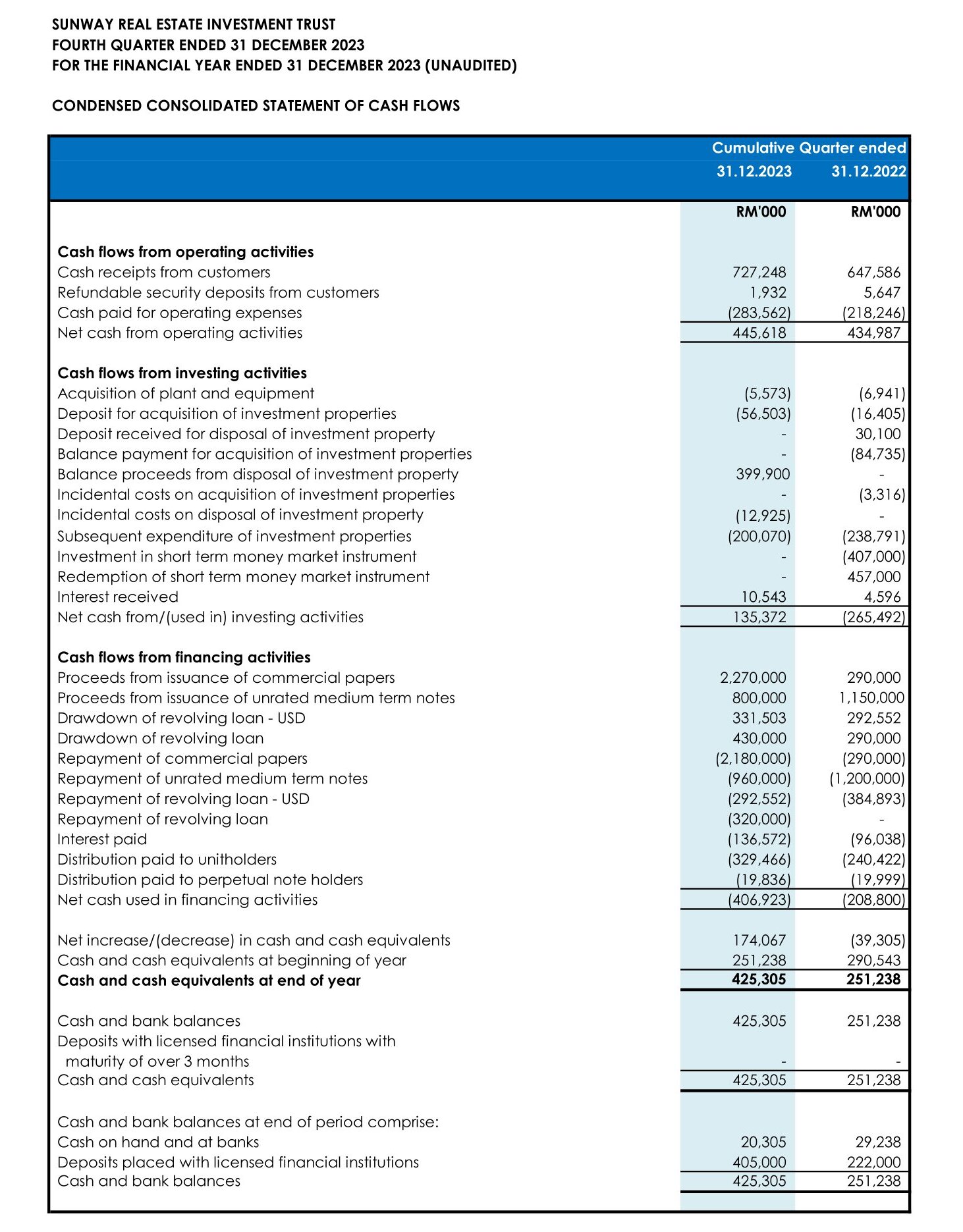

Cash Flow

Comprehensive Income

Comprehensive Income

Financial Position

Financial Position

Cash Flow

Cash Flow

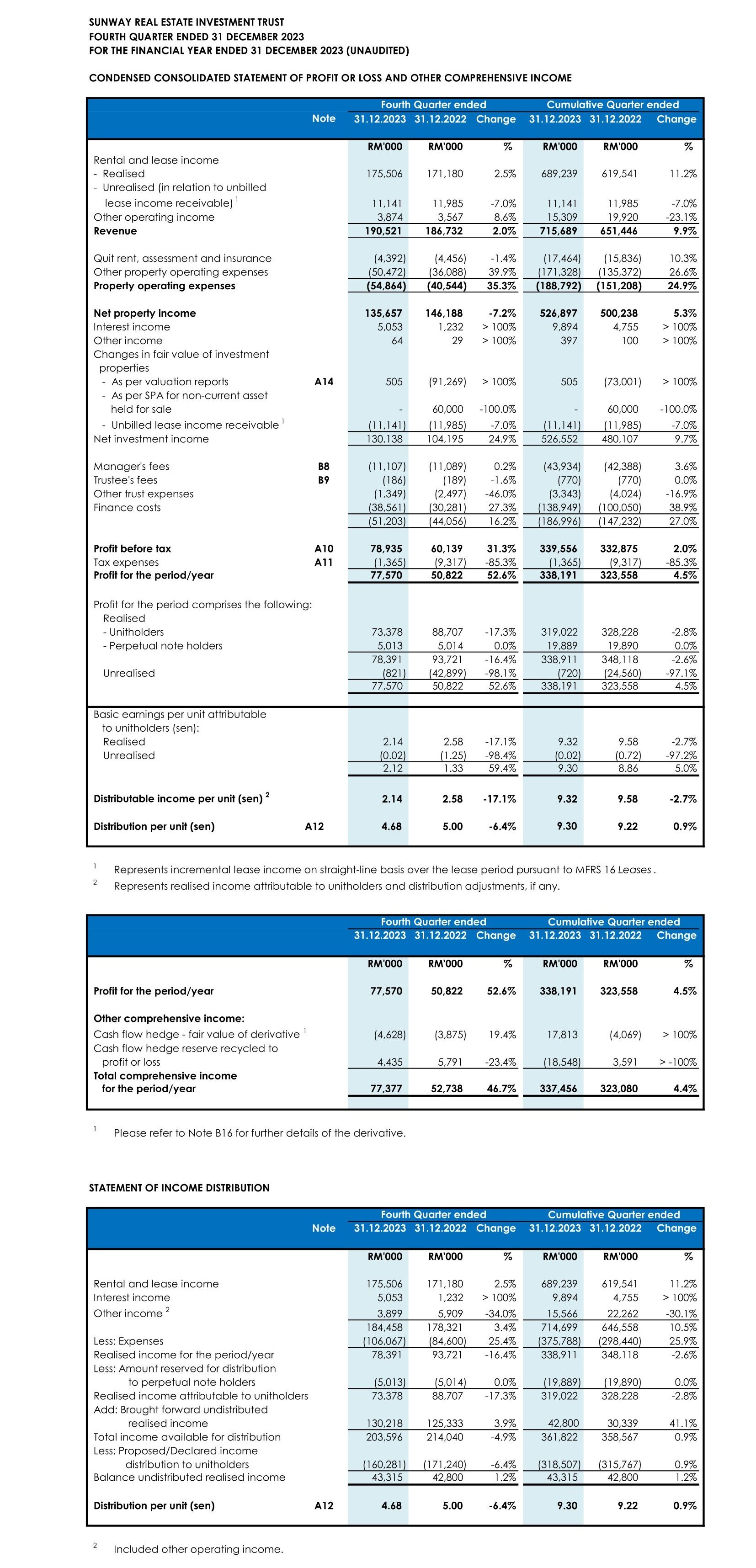

Quarterly Earnings

FOR THE FOURTH QUARTER ENDED 31 DECEMBER 2025

-

Comprehensive Income

-

Financial Position

-

Cash Flow

Comprehensive Income

Comprehensive Income

Financial Position

Financial Position

Cash Flow

Cash Flow

Segmental Performance

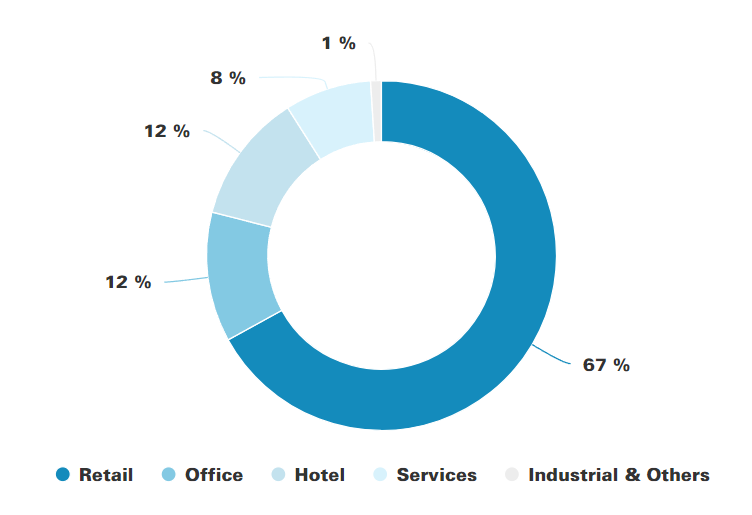

REVENUE CONTRIBUTION BY SEGMENT (FY2024)

Portfolio by Revenue (FY2024)

RM 756.9 million

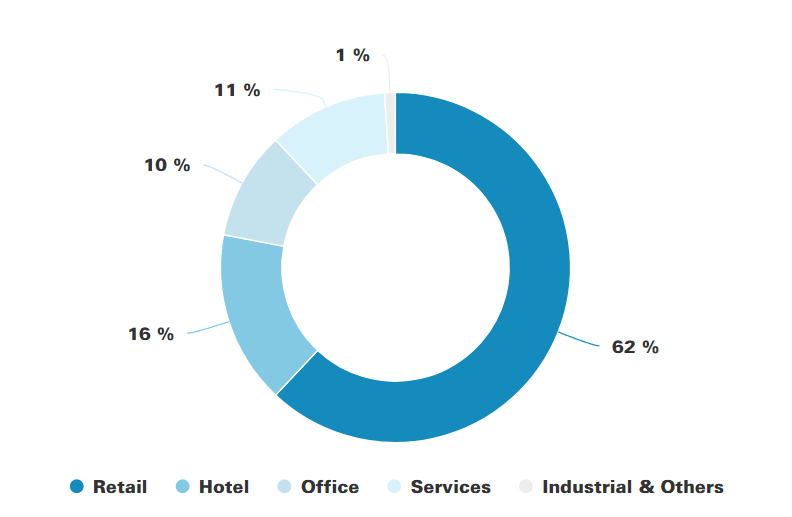

NET PROPERTY INCOME CONTRIBUTION BY SEGMENT (FY2024)

Portfolio by Net Property Income (FY2024)

RM 559.4 million

Financial Ratio

Based on Closing Price on 03rd March 2026

Closing Price (RM)

2.50

52-Week High (RM)

2.65

52-Week Low (RM)

1.55

NAV Premium1,4 (%)

64.99

Distribution Yield3,4(%)

4.00

-

Fundamentals

-

Growth

-

Profitability

-

Debt

-

Performance Benchmark

Fundamentals

| Fundamental Ratio | FY2024 | FY2023 | FY2022 | FP2021 | FY2020 |

| Earnings Per Unit (EPU) (Realised)(sen) |

10.04 | 9.32 | 9.58 | 6.68 | 7.76 |

| Distribution Per Unit (DPU) (sen) |

10.00 | 9.30 | 9.22 | 6.10 | 7.33 |

| Net Asset Value (NAV) Per Unit (Before Income Distribution) (RM) |

1.5686 | 1.5114 | 1.5149 | 1.4966 | 1.5042 |

| Net Asset Value (NAV) Per Unit (After Income Distribution) (RM) |

1.5152 | 1.4646 | 1.4649 | 1.4686 | 1.4804 |

Growth

| Growth Ratio | FY2024 | FY2023 | FY2022 | FY2021 | FY2020 |

| Revenue Growth (%) |

7.2 | 9.9 | -3.6 | 21.3 | -4.0 |

| Net Property Income Growth (%) |

8.1 | 5.3 | 9.4 | 9.7 | -5.2 |

| Profit Before Tax (PBT) Growth (%) |

55.4 | 2.0 | 71.0 | -6.1 | -47.4 |

| Net Profit Growth (%) |

55.2 | 4.5 | 65.5 | -6.1 | -46.1 |

| Realised Profit Growth (%) |

4.5 | -2.6 | 38.2 | 1.4 | -13.3 |

| DPU Growth (%) |

7.5 | 0.9 | 51.1 | -16.8 | -23.6 |

Profitability

| Profitability Ratio | FY2024 | FY2023 | FY2022 | FP2021 | FY2020 |

| Net Property Income (NPI) Margin (%) |

74.3 | 73.6 | 76.8 | 67.7 | 74.8 |

| Return on Assets5 (ROA)(%) |

4.86 | 3.55 | 3.44 | 2.14 | 2.46 |

| Return on Equity5 (ROE)(%) |

8.94 | 6.13 | 5.85 | 3.58 | 4.37 |

Debt Ratio

| Debt Ratio | FY2024 | FY2023 | FY2022 | FP2021 | FY2020 |

| Average Cost of Debt (%) | 3.89 | 3.8 | 2.98 | 2.79 | 3.66 |

| Interest Service Cover Ratio (times) | 3.2 | 3.5 | 4.5 | 2.8 | 3.1 |

| Gearing Ratio (%) |

41.4 | 38.1 | 37.6 | 37.2 | 40.7 |

| Fixed : Floating Debt | 45 : 55 | 34 : 66 | 31 : 69 | 38 : 62 | 43 : 57 |

Performance Benchmark

| Performance Benchmark Ratio | FY2024 | FY2023 | FY2022 | FP2021 | FY2020 |

| Management Expense Ratio (%) | 0.91 | 0.9 | 0.88 | 0.74 | 0.86 |

| Average Total Return (%) |

5.6 | 2.6 | 1.3 | 1.8 | 6.5 |

| Unit Price Movement (%) |

20.1 | 5.5 | 3.5 | -13 | -13.4 |

| Distribution Yield (%) |

5.4 | 6.0 | 6.3 | 2.9 | 4.5 |

| Annual Total Return (%) |

25.5 | 11.5 | 9.8 | -10.1 | -8.9 |

Notes:

- Based on FY2024 NAV per unit (after income distribution)

- Based on unadjusted closing unit price

- Based on FY2024 distribution per unit

- Based on closing price - 03rd March 2026

- Based on profit for the year

If you see any errors, please report here.