Investor Info

INVESTMENT THESIS

INVESTMENT CASE

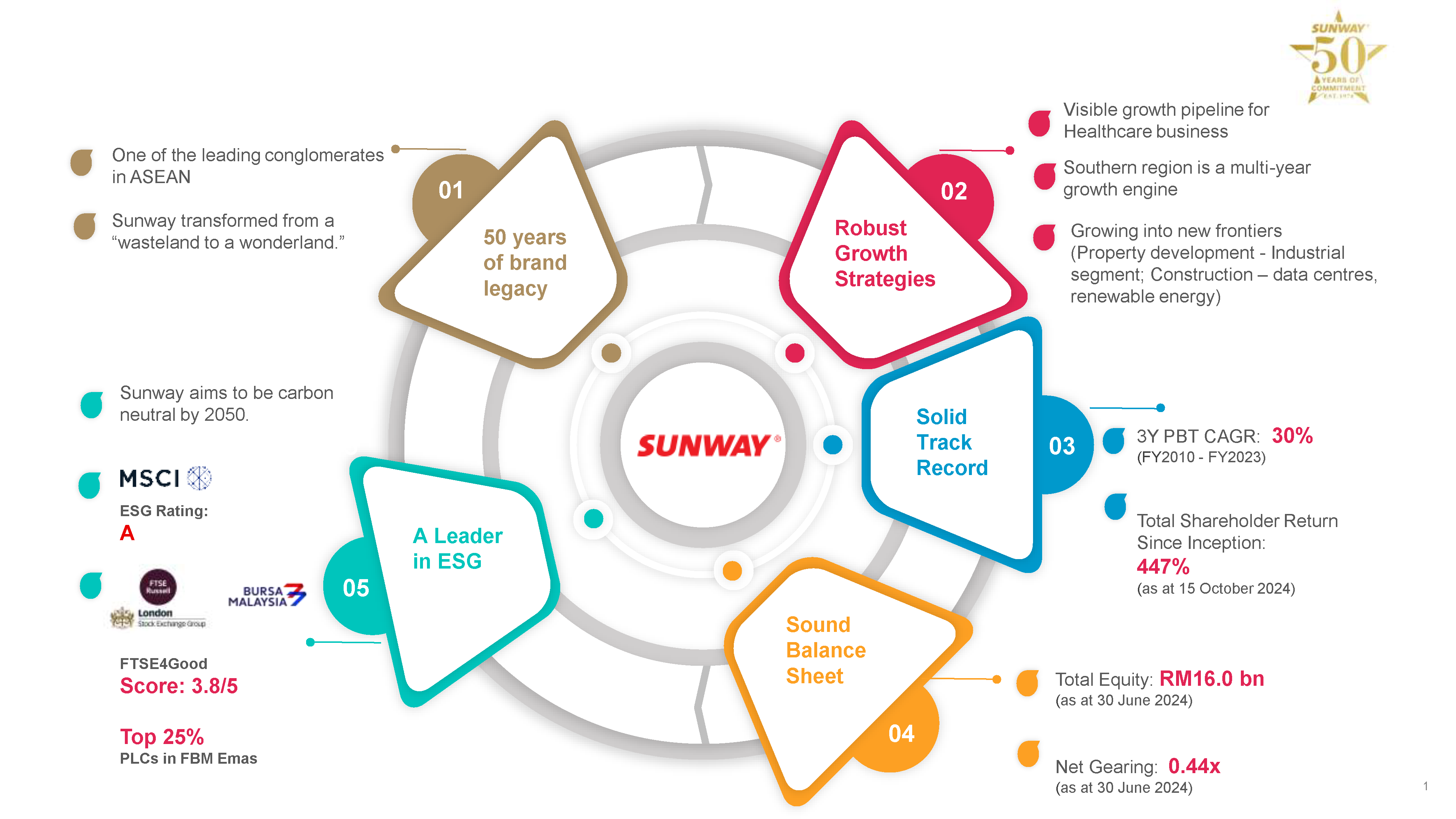

Summarised Investment Highlights

- One of the largest property group in Malaysia with a market capitalisation of approximately RM 20.2 billion as at 30 June 2024

- Developer with capacity and capability to carry out all aspects of the property development business chain.

- The management of and investment in Sunway REIT provides the Group with an avenue to divest its mature property investment assets to crystallize capital gains and yet allows it to continue benefitting from REIT management fees and rental income through dividend from the REIT units.

Land bank acquisition

Design & Masterplan

Build for Self / Others

Construction & Supply Chain Management

Build to Sell

Marketing & Sales

Build to Operate

Property Investment & Business Operators

Held for Yield

REIT & REIT Management

Chart Indicator

Integrated Properties

Construction

REIT

- Landbank of close to 2,357 acres located across multiple strategic locations with a potential GDV of approximately RM54.9 billion.

- One of the largest listed landowners in Iskandar Malaysia with 1,770 acres of land.

- Sunway Healthcare’s three operating hospitals continue to perform well, with capacity expansion on track to cater to the growing demand for quality healthcare services. The forthcoming opening of the two new hospitals, Sunway Medical Centre Damansara and Sunway Medical Centre Ipoh scheduled in Q4 FY2024 and Q1 FY2025 respectively will accelerate the growth trajectory of the healthcare segment. This will add 600 beds capacity progressively.

Klang Valley

1,108 acres (47%)

RM 13.7 bil (25%)

Johor

741 acres (31%)

RM 28.9 bil (53%)

Penang

180 acres (8%)

RM 2.2 bil (4%)

Singapore

9 acres (<1%)

RM 5.9 bil (10%)

Others

319 acres (14%)

RM 4.2 bil (8%)

- Recurring income from REIT in the form of REIT dividends and management fees.

- Unbilled sales of RM4.5 billion as at end June 2024.

- Construction order book of RM7.4 billion as at end June 2024.

- Healthcare current licensed beds of 1,158 as at end June 2024.

Financial Calendar

-

26 Feb

2025Announcement of the unaudited consolidated results for the 4th quarter ended 31 December 2024

-

22 May

2025Announcement of the unaudited consolidated results for the 1st quarter ended 31 March 2025

-

27 Aug

2025Announcement of the unaudited consolidated results for the 2nd quarter ended 30 June 2025

-

26 Nov

2025Announcement of the unaudited consolidated results for the 3rd quarter ended 30 September 2025

Analyst Coverage

Nicholas Lim

Affin Hwang Investment Bank

Team Coverage

AmInvestment Bank

Chong Tjen-San

CGS International Securities Malaysia

Mak Hoy Ken

CIMB Securities

Megat Fais

Citi Research

Joe Liew

Citic CLSA Securities

Tan Kai Shuen

Hong Leong Investment Bank

Clement Chua

Kenanga Investment Bank

Wong Wei Sum

Maybank Investment Bank

Jessica Low Jze Tieng

MIDF Research

Loong Kok Wen

RHB Research Institute

Wendy Thiam

TA Securities

Ng Jo Yee

UOB KayHian Securities