OUR BUSINESS

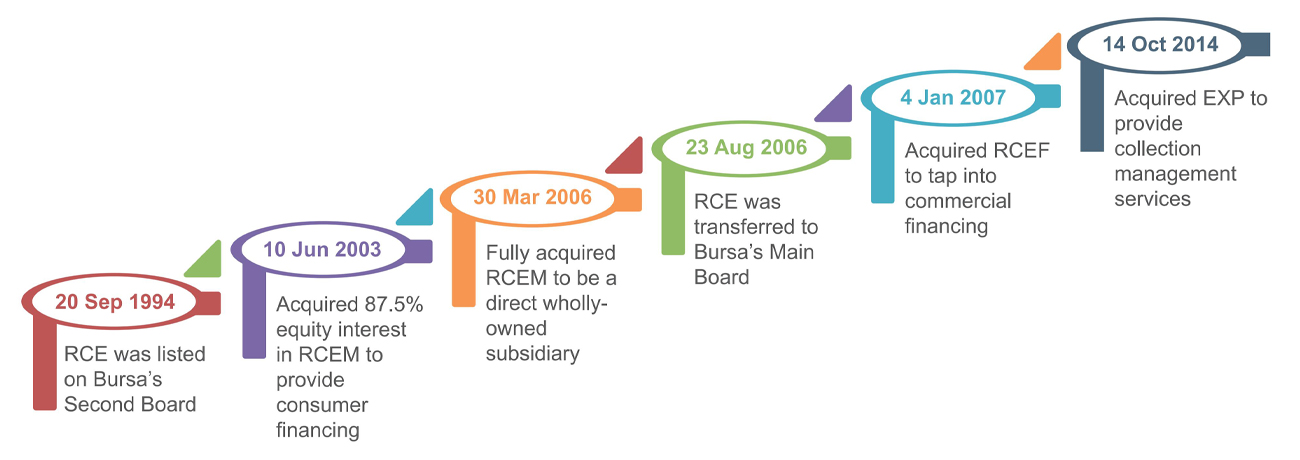

RCE Capital Berhad (“RCE”) is an investment holding company and a subsidiary of Amcorp Group Berhad. RCE is listed on the Main Market of Bursa Malaysia Securities Berhad (“Bursa”) since 23 August 2006. Our core business is the delivery of shariah-compliant financing services to civil servants with the aim of generating sustainable returns to stakeholders.

RCE Marketing Sdn Bhd (“RCEM”) and its subsidiaries as well as EXP Payment Sdn Bhd (“EXP”) are the main contributors to the Group. While collectively serve as a total solutions provider to business partners, they offer shariah-compliant and conventional financing to end customers, comprising mainly civil servants. These customers repay their financing through direct monthly deductions from their salary.

In the move to complement the business, the Group acquired RCE Factoring Sdn Bhd (“RCEF”) in 2007. RCEF offers factoring and confirming financing to small and medium-sized enterprises under its commercial segment while shariah-compliant and conventional financing are provided to selected customer segment.

The Group also acquired EXP in 2014 to provide salary deduction collection management services as an alternative to Biro Perkhidmatan Angkasa. Salary deduction services by EXP are provided under the scope of the Accountant General’s Department of Malaysia and other selected government and semi-government agencies.

OUR STRATEGY

The Group strives to maintain sustainable medium to long term returns and value creation to its shareholders guided by environmental, social and governance (“ESG”) principles and risks associated with climate change such as reputational, transitional and physical risks.

The Group remains steadfast in its commitment guided by industry best practices. To this end, the Group maintains ethical sales channels, develops products based on risk-based pricing and works towards providing exceptional customer service with quick turnaround time.

During the financial year ended (“FYE”) 2022, the Group remained true to a set goal of value creation. One strategic thrust was to honour its commitment as a responsible financier by providing quality financing products in an end-to-end shariah-compliant financing ecosystem. Additionally, meeting customers’ needs and expectations are nonetheless imperative. We approach this through appropriate technologies adoption, process innovations and holding to “Customer for Life” motto.

SUMMARY OF GROUP FINANCIAL PERFORMANCE

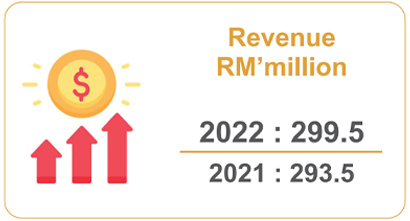

The Group’s revenue was RM299.5 million in FYE 2022 with 2.0% year-on-year (“YoY”) growth from RM293.5 million in FYE 2021. The growth was primarily contributed by higher early settlement and fee income arising from increased refinancing activities by customers and sales campaigns launched to boost the brand presence respectively.

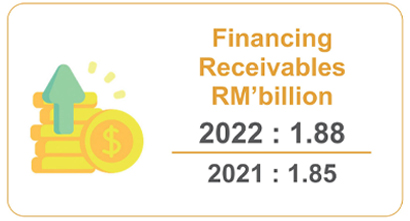

As at 31 March 2022, the financing receivables stood at RM1.88 billion, representing 1.8% growth from RM1.85 billion a year ago.

The Group’s revenue was RM299.5 million in FYE 2022 with 2.0% year-on-year (“YoY”) growth from RM293.5 million in FYE 2021. The growth was primarily contributed by higher early settlement and fee income arising from increased refinancing activities by customers and sales campaigns launched to boost the brand presence respectively. As at 31 March 2022, the financing receivables stood at RM1.88 billion, representing 1.8% growth from RM1.85 billion a year ago.

The Group’s profit expense remained at a manageable level of RM80.2 million in FYE 2022 as compared to RM80.4 million in FYE 2021. The Group monitors its funding costs to complement product development pricing through efforts in sourcing for cheaper financing, while maintaining adequate liquidity for business needs at all times. Following this, the Group’s managed to reduce its weighted average profit rate of financing liabilities by 12 basis points in FYE 2022.

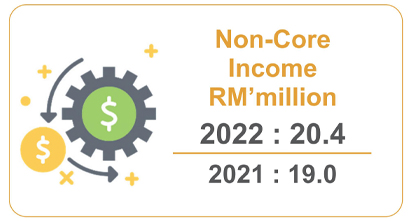

Non-core income of the Group increased to RM20.4 million in FYE 2022 from RM19.0 million in FYE 2021, largely driven by higher income generated from deposits placed with licensed financial institutions and bad debts recoveries.

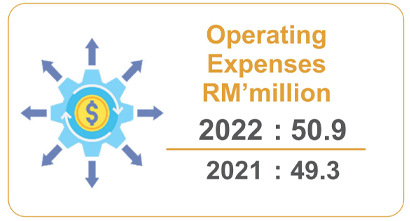

The Group’s operating expenses increased to RM50.9 million in FYE 2022 from RM49.3 million in FYE 2021. This was mainly due to higher facility fee expense in relation to newly sourced financing liabilities in current financial year. Despite higher operating expenses in FYE 2022, cost to income ratio of the Group remained at 21.1%.

On the other hand, the Group recorded lower allowances for impairment charge of RM11.5 million in FYE 2022 as compared to RM15.6 million in FYE 2021. The lower impairment allowances was due to prudent asset quality assessment, guided by the Group’s credit scoring model that was implemented since May 2013. This further reaffirms that the Group’s underlying asset quality is able to fit into its existing credit risk management and underwriting criteria. The improvement also took into account positive economic outlook reflected in the macroeconomic variables required under MFRS 9 Financial Instruments.

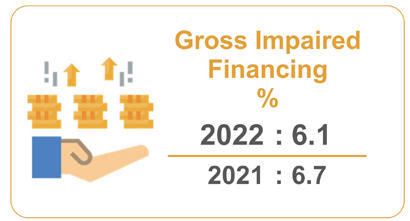

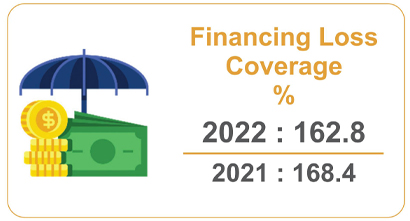

The Group’s gross impaired financing (“GIF”) improved to 6.1% in FYE 2022 from 6.7% a year ago while financing loss coverage stood at 162.8%, lower than FYE 2021 of 168.4%. These remained adequate as collections from customers were carried out via salary deduction, which mitigated the non-repayment risk.

Correspondingly, the Group’s profit before tax rose to RM177.2 million in FYE 2022, representing an increase of 6.0% from RM167.2 million in FYE 2021. As a whole, the Group delivered a commendable result with a 6.8% increase in its profit after tax to RM133.2 million for FYE 2022 from RM124.6 million a year ago.

The Group continued to demonstrate its resilience with steady return on average equity and total assets of 16.2% and 5.1% respectively.

BUSINESS OPERATIONS REVIEW

The Group strategically enhanced its business operations by benchmarking to industry best practices, refining customers service quality, adopting technologies and process innovations, which are relevant to its core business. This enabled the Group to remain robust in these few turbulent financial years by offering products catered to changing customer needs, while staying agile as the root of business adaptability and sustainability.

The Group operates in an end-to-end shariah-compliant eco-system, which is validated by Shariah Advisory Council of Securities Commission Malaysia as evidenced by the inclusion of RCE as a shariah-compliant security effective 26 November 2021. RCE is now among the four out of thirty-three securities that are shariah-compliant in the financial services sector of Bursa. This milestone is significant as it allows the Group to continue to contribute towards the promotion of a progressive and inclusive Islamic financial and securities system.

Furthermore, the Group made much progress in the context of being a responsible financier by offering products that met market demand and ensuring customers obtained financing within their credit capacities. Targeted moratoriums were provided since last financial year to customers genuinely affected by the pandemic. Another initiative was working towards customers’ financial literacy through educational articles sharing at business partners’ websites and Facebook pages.

Internally, stability of various funding sources were ensured as pre-emptive measures against disruption to business that would affect the provision of financing products. Movements in profit and interest rates are closely monitored. As it is, Bank Negara Malaysia (“BNM”) on 11 May 2022 and 6 July 2022 increased the Overnight Policy Rate by 25 basis points on each occasion. Whilst the Group is in the position to re-price our financing products in tandem with the rate increase, such decision will only be made after taking into consideration the competitive landscape as well as the Group’s appetite in absorbing the increase. A delay in increasing profit rates of financing products would allow time for customers to adapt to a rising profit rate environment.

Besides, the Group initiated several new digital initiatives, enabling faster turnaround time through online application and real-time verification to meet the demand of tech-savvy customers. Alternatively, the Sales Team continue providing hassle-free and professional services in helping less tech-savvy customers in acquiring suitable financing products. The Group also provides accessible customer service through a variety of modes such as enquiry form in the websites, Chatbots at our Business Partners’ websites and call to customer service personnel.

As for the back-end operations, the Group upgraded the database and hardware of operational systems for processing speed enhancement and growing data size accommodation, apart from the regular penetration tests conducted by the external consultants to identify security vulnerabilities. To prevent unauthorised access, a data loss prevention platform was implemented since January 2022.

As well as all of the above, the Group embeds sustainability solutions in its daily operations to minimise disruptions to business activities. These include establishment of virtual private network and meeting platforms to facilitate remote working arrangement at any point of time and conversion of hardcopy forms into online applications for internal administrative matters. The Group is also evaluating suitable models to assess the potential cost of climate change to its operations and also implementing effective adaptation approach to the impacts.

In addition, our credit risk strategy remains anchored around a balance between credit quality, profitability and sustainable growth. It is formulated by keeping in mind the Group’s overall credit risk appetite and exposure. We also carry out periodic reviews on credit policies and underwriting criteria to ensure that they stay up to date.

LIQUIDITY RISK MANAGEMENT

With regards to liquidity risk management, the Group adopts a vigilant approach in maintaining sufficient liquidity through short and long term financing at favourable terms. Another strategy is the Group’s constant management of profit rate risk by maintaining an optimal mix of fixed and floating rate financing liabilities.

With the anticipated profit rate hikes by BNM as a pre-emptive measure to head off inflation, the Group continues to source for new financing to broaden the choices of its existing financiers. This bodes well in allowing the Group to hedge against the unfavourable impact of the profit rate hikes with the availability of different sources of financing such as sukuk, term financing/loans and revolving credits.

As at 31 March 2022, the Group’s financing liabilities stood at RM1.80 billion, equating to a net gearing ratio of less than 2 times.

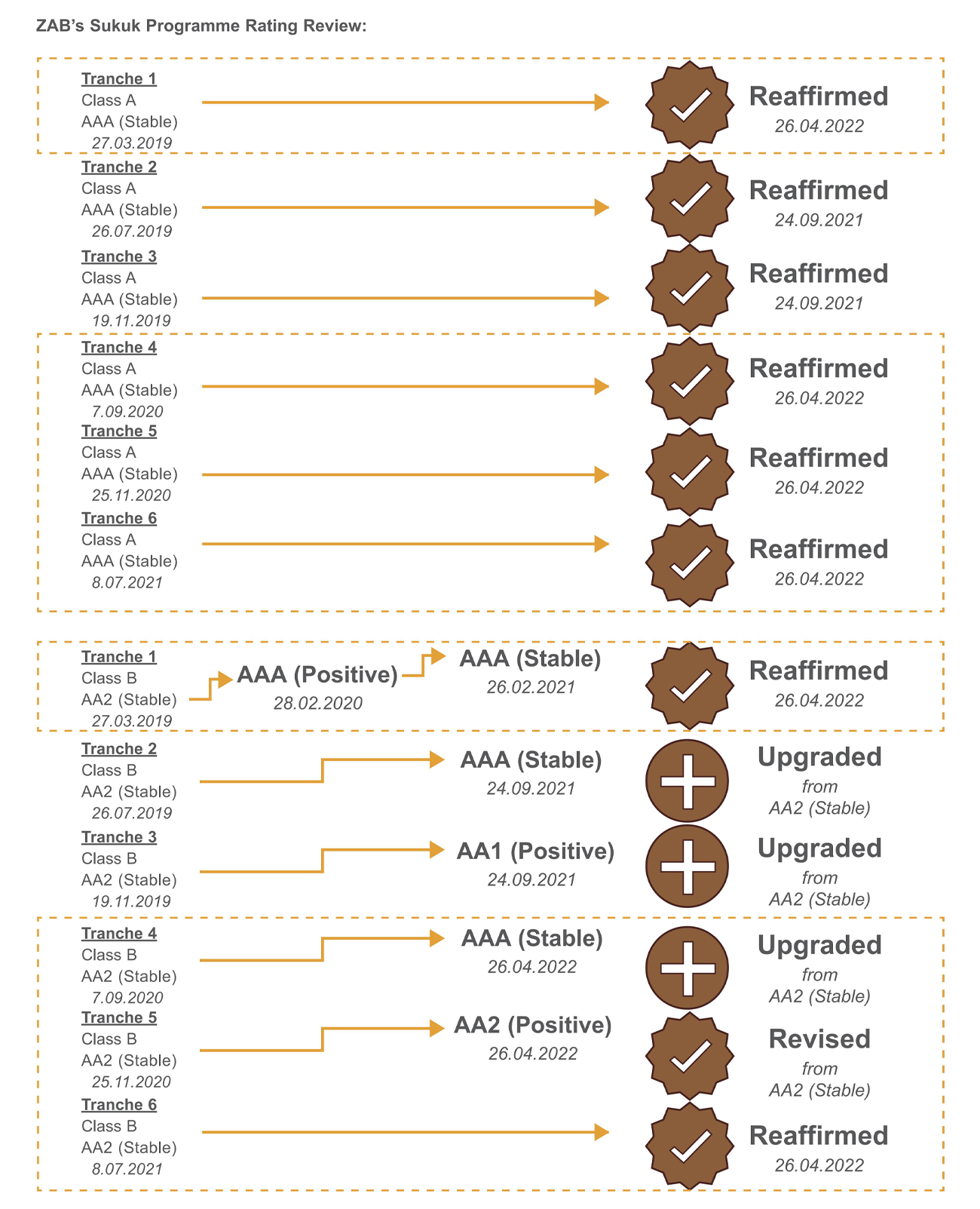

The Group’s RM2.00 billion Sukuk Murabahah Asset-Backed Securitisation Programme (“RM2.00 billion Sukuk Programme”) via Zamarad Assets Berhad (“ZAB”) was established since March 2019, which provides long term funding due to its perpetual nature. This allows better asset liability management as it enables mitigation of the mismatch in cash flow timing. ZAB has to-date successfully issued sukuk totalling RM1.11 billion in seven tranches, out of which RM124.0 million is internally subscribed by RCE Trading Sdn Bhd, a wholly-owned subsidiary.

In FYE 2022, ZAB activated the Revolving Option (“RO”) feature of its RM2.00 billion Sukuk Programme, the first in Malaysia. This allows ZAB to purchase additional receivables from RCEM, a wholly-owned subsidiary of RCE by utilising its excess funds from the sinking funds. The proceeds received by RCEM will be subsequently used to generate new disbursements, thereby minimising negative carry and providing stable funding for the Group. ZAB’s sixth and seventh tranche with RO feature were issued in July 2021 and March 2022 with issuance size of RM124.0 million and RM255.0 million respectively.

On 10 December 2021, ZAB received the “Most Innovative Islamic Finance Deal Of The Year & Best Islamic Finance Deal Of The Year” by Alpha Southeast Asia 15th Annual Best Deal & Solution Awards 2021 for its sixth tranche issuance.

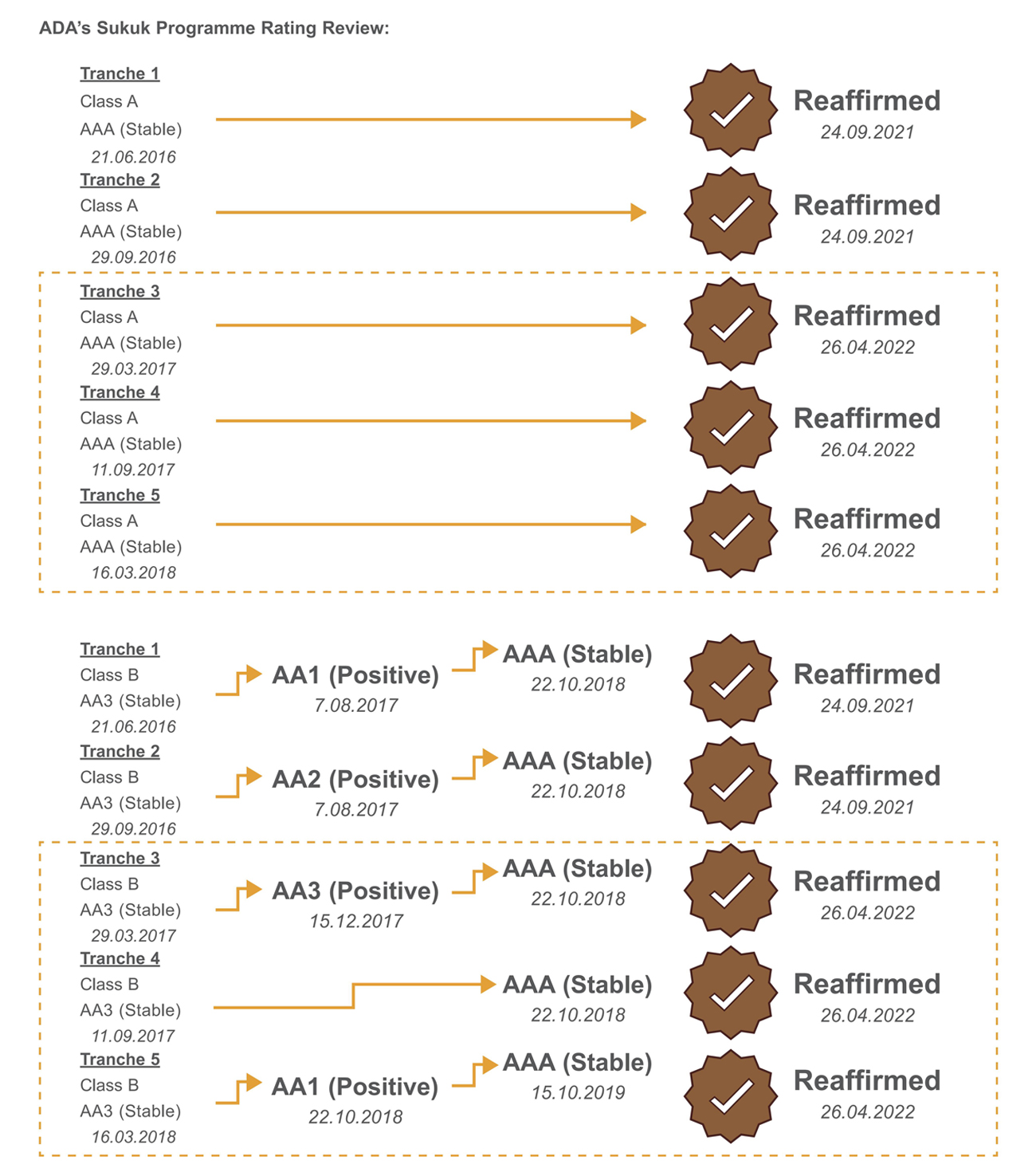

Other than ZAB’s RM2.00 billion Sukuk Programme, the Group has another RM900.0 million Sukuk Murabahah Asset-Backed Securitisation Programme (“RM900.0 million Sukuk Programme”) established via a special purpose vehicle, namely Al Dzahab Assets Berhad (“ADA”). It has fully utilised its programme limit with five tranches issued since June 2016 and continues to meet its financing obligation through collections received from the underlying securitised receivables.

Both ZAB and ADA’s Sukuk Programmes are rated by RAM Ratings Berhad. The upgrading and reaffirmation of ratings over these financial years reflect the Group’s strength in ensuring the quality of its underlying securitised receivables remain sound.

In addition to the above, the Group successfully sourced for new secured and unsecured banking facilities amounting to RM140.0 million and RM43.0 million respectively in tandem with its direction to broaden the choice of financiers.

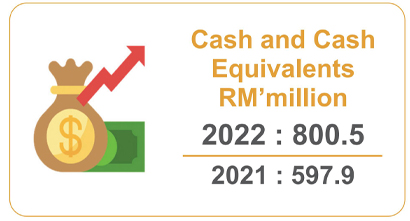

The Group maintained a higher cash and cash equivalents balance of RM800.5 million as at 31 March 2022. Out of this amount, a total of RM647.6 million (FYE 2021: RM571.0 million) was in relation to deposits with licensed financial institutions. These deposits were mainly derived from collections remitted into sinking funds for future payments of sukuk principal and profit expense and managed by independent trustees of the Group’s respective sukuk programmes. The deposits are placed with licensed financial institutions with proven track records and competitive placement rates.

CAPITAL MANAGEMENT/INVESTMENTS

The Group practises effective capital management for the sustainability of our core business. In FYE 2022, the Group focused on maintaining a strong base as its capital management strategy, compliance with regulatory requirements and expectations of various stakeholders.

The leveraging of information technology has helped in smoothening out the deliveries to all stakeholders. In this aspect, the Group has allocated RM1.9 million and completed several initiatives in FYE 2022 as stated on Business Operations Review in this Management Discussion and Analysis.

The Group also engages external consultants for periodic penetration testing to mitigate the increased in cybersecurity risks and ascertain assurance level is accomplished with comprehensive safeguards. This complements the ongoing investments in technology upgrades and process automation, which are instrumental for the Group’s future growth and sustainability while maintaining business buoyancy, particularly in disruptive times.

OUR PEOPLE

To us, people growth is synonymous with business growth. This reflects the Group’s unwavering belief in employees as the most valuable asset and pillar of success.

The Group maintains constant efforts in cultivating and retaining its talent pool. In FYE 2022, the Group strengthened the employees’ competencies through investing in talent management and leadership development programmes. The Group asserts that in an uncertain and frequently changing environment, its workforce crucially needs an agile mindset and equipped with the right skills and tools to thrive. As a matter of best practice, all employees are updated promptly on all relevant policies and procedures.

For further details about our people, please refer to Employment Management and Development section in Sustainability Statement that can be found in this Annual Report.

OUTLOOK FOR 2022/FYE 2023

According to the World Bank, global growth is expected to slow from 5.7% in 2021 to 2.9% in 2022, resulting from pent-up demand dissipates, normalised fiscal and monetary support across the world.

The pronounced slowdown is also amidst fresh threats from Russia-Ukraine military conflict, COVID-19 variants, labour market challenges, supply-chain constraints, rising inflation, debt and income inequality that could endanger recovery in emerging and developing economies.

As for Malaysia, Bank Negara Malaysia forecast for economic growth in 2022 is between 5.3% and 6.3% (2021: 3.1%). The projection is based on the anticipation of increasing international and domestic economic activities, improved exports and expanding vaccination rates. Moreover, increasing private sector consumption is expected to facilitate demand for domestic goods and services.

However, risks to the outlook will remain tilted to the downside due to a potential weaker-than-expected global growth, worsening supply chain disruptions and the emergence of vaccine-resistent COVID-19 variants of concerns.

Moving forward, the Group is prepared to face uncertainties and challenges that may arise as it continues with prudent costs management and close monitoring of collections. The Group will formulate sales and marketing initiatives to boost disbursement and capitalise on financing demand, creating value for customers and shareholders alike.

The Group is also mindful of its ESG commitments for business sustainability. Hence, it consistently calibrates its strategies and operations with ESG-related principles in mind, while also prioritising employees’ health, safety and well-being.

Lastly, the Group will deploy technology to remain competitive and relevant. As value is increasingly being delivered through the digital economy, the Group will stay alert to innovations that can further improve its operations and deliveries.